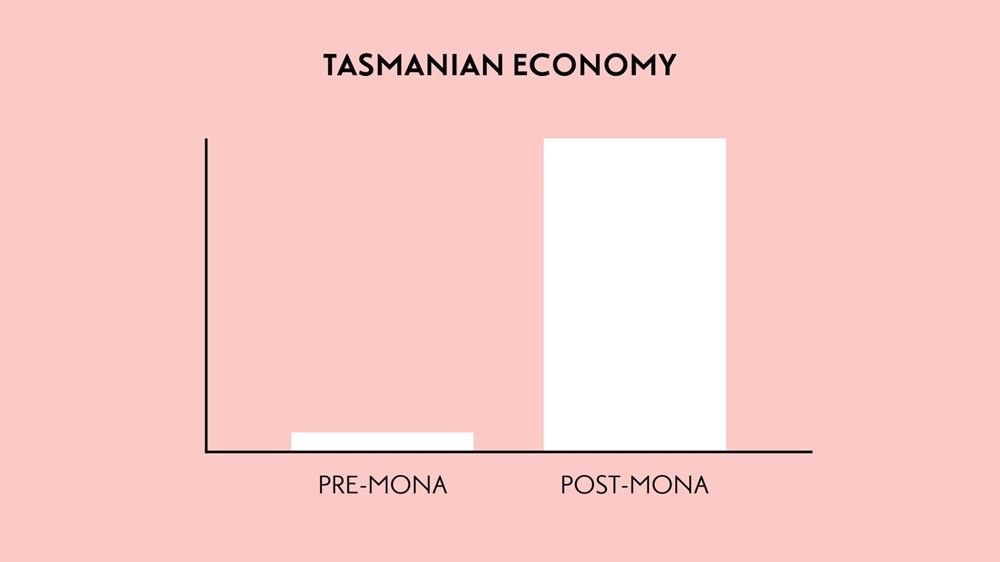

A few years ago, I was invited to do the keynote for the Tasmanian Economic Forum. You’ve got the wrong person, I told them. Of all subjects on earth, economics is the one I know least about. And definitely care least about. One need only begin to say the word, econo … zzzzzzz … and I’m snoozing off. But they insisted: they wanted someone from outside their world, someone fresh, to shake things up. Fine. But I should at least offer something relevant to their forum. So I did some calculations and presented this graph:

Now it just so happened that I had recently bought a house in New Orleans for $42,000. It was a rundown piece of shit in a less desirable neighbourhood (is that politically correct?). Obviously it was desirable to me—I bought it. It was in dilapidated condition, to put it mildly, but growing in the backyard was a 100-year-old oak tree. I thought, that’s got to be worth more than $42,000. Why wasn’t the tree factored into the price? Does it not have a value? I felt like that art vulture at the garage sale offering fifteen dollars to an unwitting Margaritaville-attired retiree for a long-lost Bonnard.

I was thinking about economics—I had a keynote to give! First, what even is economics? It has something to do with value, I decided. I didn’t look this up to confirm because, well … zzzzzzz (that earlier problem). Now, I do know something about diamonds. I once went to the wedding of an Indian diamond baron’s daughter. And I wore a champagne diamond of alluvial origin. It was expensive—relatively, I don’t actually give a fuck about diamonds, I prefer my husband pay for my social projects. It was expensive because diamonds are ‘rare’—we’ll put that in quotation marks because they’re not actually that rare; the diamond companies trickle them out to create a false scarcity so they can charge more. Moral of the story: Rare = expensive. Scarcity increases value.

You know where I’m going with this. Lately humans really love mowing down vast swathes of forest. Large portions of the Amazon were incinerated during Bolsonaro’s spirited three-year rule. The capital of Indonesia is moving to Borneo—we can all imagine what that means. All the while, Ugandan generals have been funding their armies on the sale of Congolese rainforest to Russian and Chinese buyers. We all want wood. I just built a beautiful wooden, architecturally designed (by me) house in Tasmania. But the global stock of pristine forest is dwindling. What this should mean—according to a basic principle of economics—is that the value of pristine forests is increasing. In the case of diamonds, a false narrative of scarcity has been created to inflate value. With the world’s old-growth forests, the scarcity is real.

In Tasmania, the ‘F’ word has a contentious, anguished history. Remember the bumper sticker ‘Keep Warm This Winter: Burn a Greenie’? There’s been some bad blood. So waltzing into Tasmania circa 2010, an innocent stranger, I noticed things were a little ‘tense’. You could cut the air with a chainsaw. I decided to stay out of it—for a decade, just while things cooled off. But now I’m thinking—what happens if we take all the emotion out of it? (I’m of German descent.) What if we look at forestry through a purely economic lens? With my newfound passion for economics, I’ve decided to pose a question: what is the actual value of Tasmania’s forests? And how can this value be translated into outcomes that work for the state as a whole, with longevity?

I don’t have the answer, obviously. Luckily, 120 of the smartest people in the world are coming to figure it out. Actually, most of them are already here—as in, they’re Tasmanian. But we do have a Nobel prize–winning economist joining us, along with a few other less exciting experts from Harvard and the likes. Plus scientists, First Nations leaders, community leaders, conservationists, policy think tanks, artists, artisans and boatbuilders, to name a few. And David’s been reading the papers—he’s smarter than all of them. We’re all meeting at Mona this November for the Forest Economics Congress: New A$$. Class to investigate opportunities for our forests, and employ the best scientific, economic strategy, beyond political and cultural lines. The Congress is about imagining and modelling an optimal future; one that includes everyone. (Except those fucking mainlanders!) But that means parameters. As an artist I am nothing without parameters. As an economist … shit, I’m not an economist.

But parameters: first parameter, Tasmania’s regional communities and Aboriginal people are critical. Parameter one of the Congress is that these communities benefit from an appropriate valuing of the forest. Another parameter: no logger left behind. My mentor John Perry Barlow once said, ‘never assume that the motives of others are less noble to them, than yours are to you’. I have recently made friends with one of Tasmania’s premier sawmillers. He is a good guy. He just needs to keep his team employed and continue to support the entire town that relies so heavily on his business. So part of a successful model is: Everybody wins.

Do I sound too optimistic? There is ideology, and then there is reality. Principles, and practicality. Well, after running through three pairs of heels and five tubes of lipstick over 70 meetings, 80 martinis and 1000 oysters with key stakeholders—hey, I’m not an elected official, I can buy and be bought by anybody—muddy trips to sawmills, and sparkly ones to Parliament House (sans martinis) with all the important people who hate each other; 100 dissenting papers, 1000 zooms and 10,000 telephone calls—I am feeling optimistic!

As is often the case in economics, we need to see some numbers! So I’ve invited a think tank and a research institute to look at Tasmania’s numbers and write a robust report that shows what we have now and what we might have in the future. Of course, even these ‘objective’ numbers are contentious. Different accounting + personal takes = differing perspectives on how to measure things. Plus—why did they have to wear the equivalent of ninja suits (FOI acts) to access the data?

Accounting acrobatics aside, neither the Congress nor Mona hold a resolved view on this. We believe in the scientific process, which is the art of not knowing. Even if we wanted to, knowing would be impossible. Take the definitions—a cluster-fuck. What anyone means when they say ‘native’, ‘regenerated’, ‘primary’, ‘old-growth’ or ‘plantation’ is subjective, or a matter of your perfectly neutral financial interests. Then there are the many interpretations of biodiversity. I’ve noticed almost everyone finds the definitions problematic, so we might look at that at the Congress.

Let’s zoom out: excess carbon is the biggest issue we have as a species. We need to not only stop emitting it, but also remove existing carbon from the atmosphere. We are innovating—transitioning to renewables and investigating sequestration—but in the meantime, forests play a key role in carbon management: photosynthesis is a powerful tool. It’s the only proven carbon capture and storage we have. But humanity’s hunger to consume is even more powerful, we’re disappearing forests at an alarming rate, so we need to put a value on them that reflects the importance of their role in the carbon emergency (not to mention biodiversity). Policy makers and market analysts are figuring out how to redirect our greed—more on that in a moment. Meanwhile, countries are setting emissions targets, and these are likely to become increasingly ambitious. Australia has signed up to the Paris Climate Treaty, so we have the Clean Energy Regulator and Safeguard Mechanism. High-impact native forest logging is expensive and falling out of favour (VIC and WA recently ended native logging), driven by government policy, community-led litigation, and rising consumer demand for ethical timber from suppliers and retailers.

OK, deep breath. This is where the carbon market comes in. The Congress will explore—and I hope, refine—carbon offsets. So far, they’ve been complete shit. (The man who so eloquently demonstrated how they are shit will be attending the Congress.) And some Greens have some very persuasive arguments for why they will be shit no matter what. They could be right; offsets may not solve our carbon problem (namely the one heating up the planet and first killing all the poor people then all the rich people when the remaining poor people arrive pissed off with weapons). Currently carbon offsets are for removals that are temporary while the emissions are permanent. But many thinkers believe offsets, while not a long-term solution, could play a role in moderating global warming while preserving our rapidly diminishing biodiversity (i.e., offsets are worth considering because Ugandan generals won’t stop clearfelling the Congolese rainforest unless they stand to profit more by letting it be). Of course, if we don’t get carbon sorted quickly enough the forests will dry up and burn anyway, and the biodiversity we sought to protect will be lost regardless. So there’s a debate: either offsets are problematic (they give licence to oil and gas while creating the illusion of progress) or they are a market mechanism to protect forests while we work carbon out, a stopgap with a shelf life. Those in the latter camp are envisioning a nature repair market built around biodiversity and cultural value. While the respective parties have been mulling this over, the market’s had its own ideas—there is now a significant and growing demand for high-integrity offsets. Companies are seeking credits with good provenance, driven partially by new corporate ethics and partially by fear of impending regulation. Motivations aside, this demand creates an opportunity—perhaps Tasmania could fill this gap with a high-integrity, good provenance Tasmanian-branded biodiversity and cultural credit? (Very on brand for Tasmania.) If so, how are the proceeds invested? Are there First Nations and rural community funds? How do Tasmanians benefit? Putting this on the table will definitely bring the pitchforks to my door except, guess what? I don’t have the answer! That’s what the Congress is for.

I’d be misleading you if I didn’t say I suspect we’ll discover that old-growth forest is worth more standing than cut down. But I am prepared to be wrong. It is not learning and it is not science if you know the answer in advance. The Congress will help make things clear. We’ll talk about it all over a (few) glass(es) of wine.

Let’s move on to the cost of wood: it’s too low! Where can I buy a giant slab of a five-hundred-year-old tree for 500 dollars? Tasmania. All I’m saying is, buy buy buy!! I’m buying it all and putting it away in a giant shed. Which is basically what hydro wood is (rainforest trees preserved in previously dammed lakes). And although I am an investor in Hydrowood (I’m not stupid, I know what this stuff is worth), I think we should distribute some of this asset to the Tasmanian people as a ‘bank’ (sorry Andrew, I’m not much of a capitalist), like the people’s bank, except not for all people, just talented artisans, furniture makers and boat builders. A super elite bank for exceptionally talented people. This would sustain our cultural heritage into the (inevitable) future (where wood costs a fortune), which is good for our brand, brand Tasmania (and we’re into that).

But who else is using Tasmania’s hardwood? Architects. They (we!) are a problem. A real problem. If we charged what wood is actually worth, architects wouldn’t use so much Tasmanian hardwood, and we could supply what is used sustainably. But they love wood and might start importing really unethical stuff from Malaysia. So we need to shame the architects into not using naughty wood and paying more (the true value) for good wood, our wood. Which means they won’t use much—too expensive—so we need to get them to fetishise plantation timber since that’s all anyone will get anymore. (Sexy pinus radiata, not as hard as we might want, but it does the job.1) There is no end to the virtue signalling opportunities in plantation timber. Architects can impress each other ad infinitum with their consciously curated wood, unless they want to buy diamonds, actual diamonds, from our super scarce, super special, super expensive hardwood bank. All of this depends on law (the state makes it this way) or the market (market demand for good provenance). In the case of provenance it’s like organic food—people pay for it. Tasmania should be the Hill Street2 of biodiversity credits and wood.

One thing everyone agrees on: the time is now. Markets are emerging, countries and corporations are trading, and global models are being defined and actioned. We don’t want Tasmania to be left behind. Let’s get the best market mechanisms in place and set a model. The whole world could look to Tasmania for the blueprint—a unique, bespoke cultural approach to forestry.

Through art, science and radical diplomacy, New A$$. Class will advance our understanding and make a formative contribution to this emerging era of forestry. We’re committed to open and constructive discourse. We believe that understanding is deepened and refined by thoroughly examining ideas through the lens of opposing views, and the sharing of diverse knowledge. Amen.

The Forest Economics Congress will be held at Mona 28–30 November.

1. OK, pinus radiata is a hard sell because it is a softwood, but we’ve all used onyx on a bar bench (hopelessly soft) and then of course there’s eucalyptus nitens which is perfectly strong and beautiful.

2. Fucking fancy grocery store.